Welcome to 2020: You’re a Child Criminal

We’ve lost everything. America’s transformation is complete.

A simple enough prospect:

- for six months,

- from November to April,

- find a someplace to live in America without freezing-themed Winter weather,

- where a car isn’t necessary day-to-day (food, gym, furnishings),

- in a reasonably safe area,

- under $1500/month

Little did I know I had awakened The Great Beast of taxes, fees1, and incorrect spreadsheet formulas.

First: Check Craigslist

What options do we have? Let’s check the local craigslist room for rent listings first.

On second thought, let’s not check craigslist.

Next: Look for Local Apartments

For a more sensible starting point, let’s look at three apartment complexes within walking distance of each other.

Here’s an actual footnote from Complex 1’s info sheet:

“Other Billable Items Include HOA, Pest Control, Parking Lot Maintenance, Common Grounds Electric, Common Grounds Gas, Billing Service Fee, and Sales Tax. A $15.35 One Time New Account/Set Up Fee Will Be Assessed To The First Bill And A $5.12 Final Bill Fee Will Be Assessed To The Last Bill. Fees Are Subject To Change At Any Time And Without Notice. All Fees Listed Above Include a 2.3% Tax. Revised 10/16/2019”

What is the point of having a “rent” payment when the property picks out 20 maintenance fees and charges them in excess of your rent? Have you ever bought a banana from a grocery store for $0.19 then got stuck with an extra $20 fee for “trucking your damn banana from costa rica to new york?” No, we expect prices to be inclusive of all their inputs required to deliver the final product, which seems to work, except when it comes to anything related to renting apartments or property management.

Congratulations on joining our community, here’s fees to join and fees to leave and we can change fees anytime without your consent. What are you going to do, move? What are you going to do, sue us? No, you’re going to pay the fees (private taxes without representation) and have no recourse to advocate for your own interest. You want fair treatment? Buy a house, loser.

Here are three apartment complexes all in the same area and built around the same time with the same build quality. Rental rates are for their smallest units on a 6 month lease:

| What | Complex 1 | Complex 2 | Complex 3 |

|---|---|---|---|

| Application Fee (per applicant) | $51.15 + 2.3% Rental Tax | $50.13 + 2.3% Rental Tax | $45.00 + 2.3% Rental Tax |

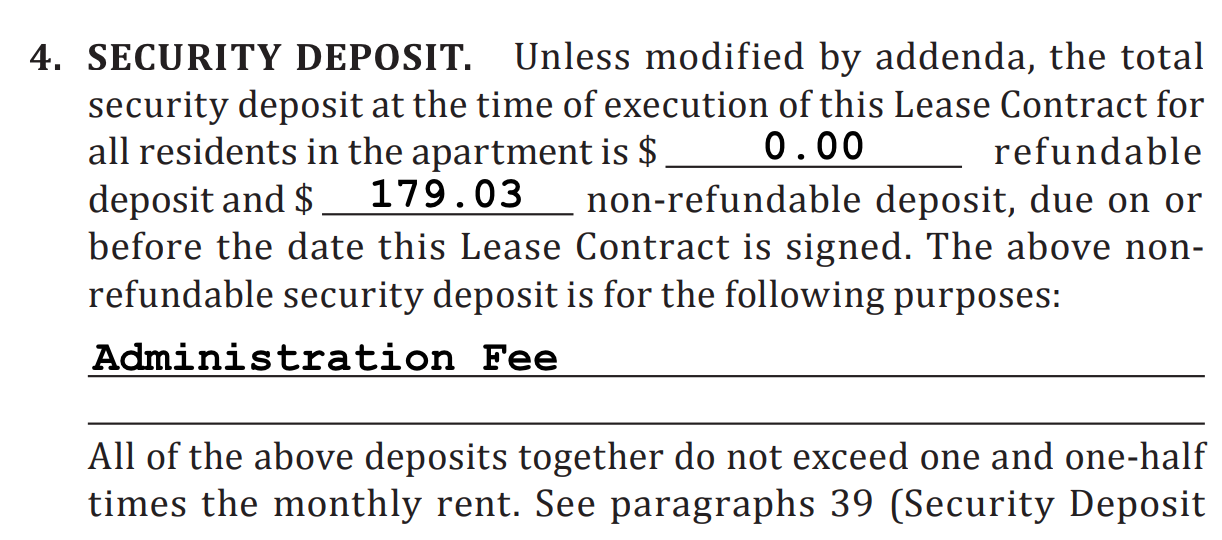

| Administrative Fee (??) | $179.03 + 2.3% Rental Tax | $204.60 + 2.3% Rental Tax | $175.00 + 2.3% Rental Tax |

| Monthly Rent (6 month lease) | $1,245 to $1,363 + 2.3% Rental Tax (changes daily by algorithm) | $1,123 to $1,245 + 2.3% Rental Tax (changes daily by algorithm) | $1,062 + 2.3% Rental Tax |

| Security Deposit | $150+ | $500+ |

|

| HOA Fee (mandatory, city requirement) | $7.50/month | $7.50/month | $7.50/month |

| Renters Insurance | $12/month | $12/month | $12/month |

| “Valet Living” Fee (picks up your trash at your door, mandatory) | N/A | $25.00/month + 2.3% Rental Tax | N/A |

If you live in most of the civilized world, you may notice it odd everything has ‘+ 2.3% Rental Tax.’ Oh, did I forget to mention we’re not in civilization anymore? This is America! This city has a mandatory 2.3% tax on all apartment rent. Of course the rental companies don’t absorb the tax into their existing prices; they happily pass it along above their listed rates. The tax even applies to your security deposit, application fees, “administrative fees,” and anything else you pay to your housing provider.

The city website says everything paid alongside rent is taxable as a Transaction Privilege Tax:

What residential rental income is taxable? All payments made by the tenant or on behalf of the landlord are taxable (list is not inclusive).

Common income sources

- Rent

- Non-refundable and forfeited deposits

- Late payment fees

- Pet fees

- Federal rent subsidies (HUD)

Fees passed onto the tenant

- Common area fees

- Maintenance charges

- Homeowner association fees

- Landscaper maintenance

- Property tax

- Pool Service

- Repairs and/or improvements

The property tax passed on to the tenant is taxable — the TAX is TAXABLE2!

Anyway, moving on…

Other monthly service fees regardless of location will include:

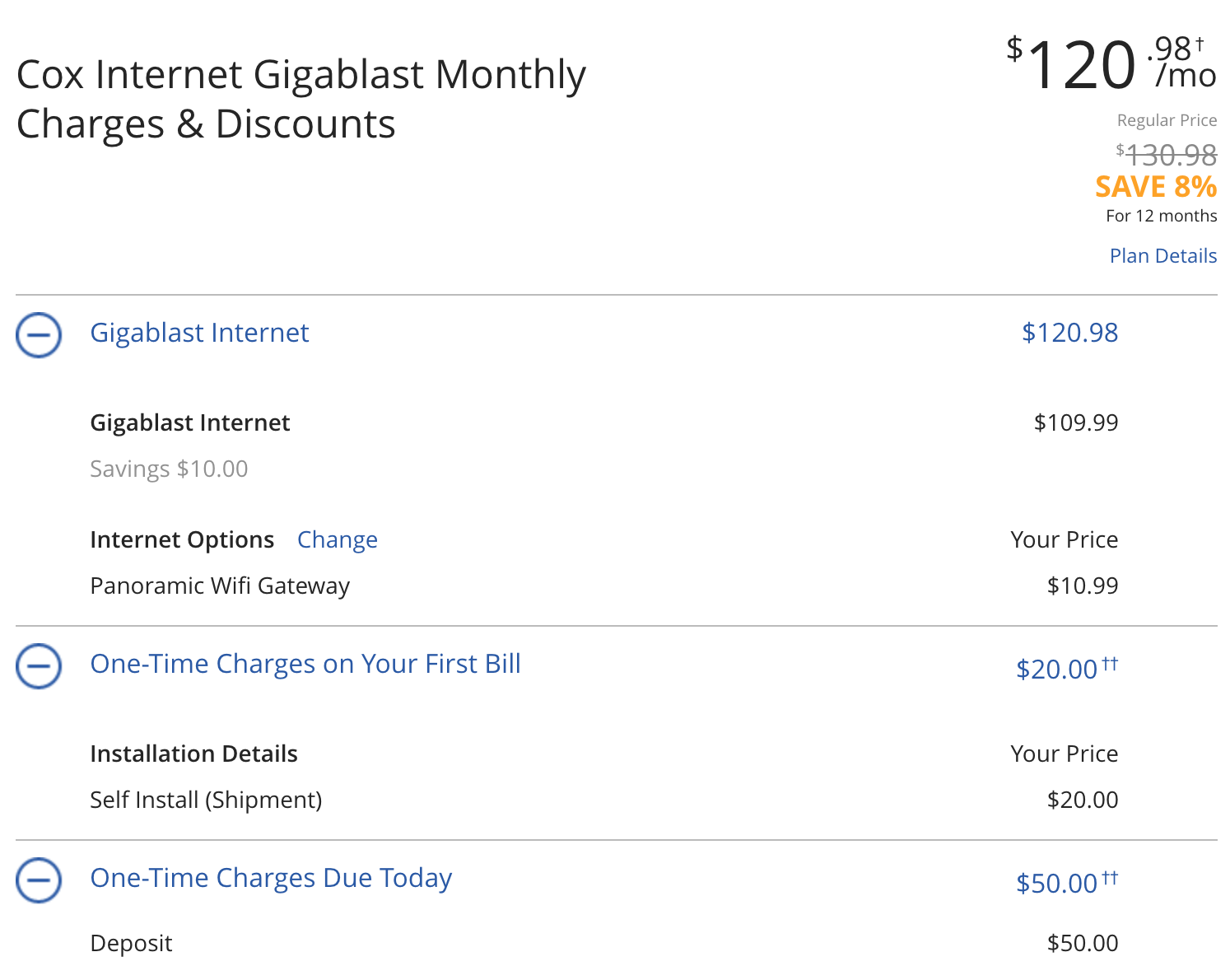

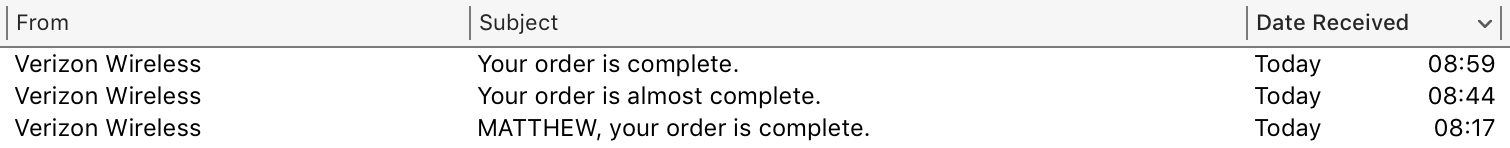

- Internet (is your internet the MOST HARDCORE MASCULINE EVER? BLAST YOUR GIGS with: GIGABLAST!): $110/month + $11/month modem+router+wifi rental + $50 device deposit + $20 “self install fee”

- Power: time of

use billing, winter rate schedule

- Update: Upon receiving my first power bill, there’s a $30 “Service Establishment Fee” — their system is 100% electronic, transfering electric billing to a new tenant costs them literally nothing. Thanks, society! Also, they have an additional $2 fee if you pay by credit card.

- Integrated Water / Trash / Common Area fees through 3rd party billing provider (+ billing provider service fee)

We have our options now. All places have excessive “Administrative fees” which don’t really make sense3. The last time I applied for an apartment (NYC, fancy building, 35th floor, $3,000+/month rent) the only upfront charge was one $75 application fee4. None of this “$200 + tax administrative fee + billing provider fee + monthly billing fee + monthly fee fee” consumer abuse we can’t seem to contain.

Check Reviews

Knowledgeable consumers use all resources to evaluate purchases. Let’s check a review:

Perfect! Let’s apply there.

Apply Now

I haven’t applied for an apartment since 2013, so let’s see how it works now.

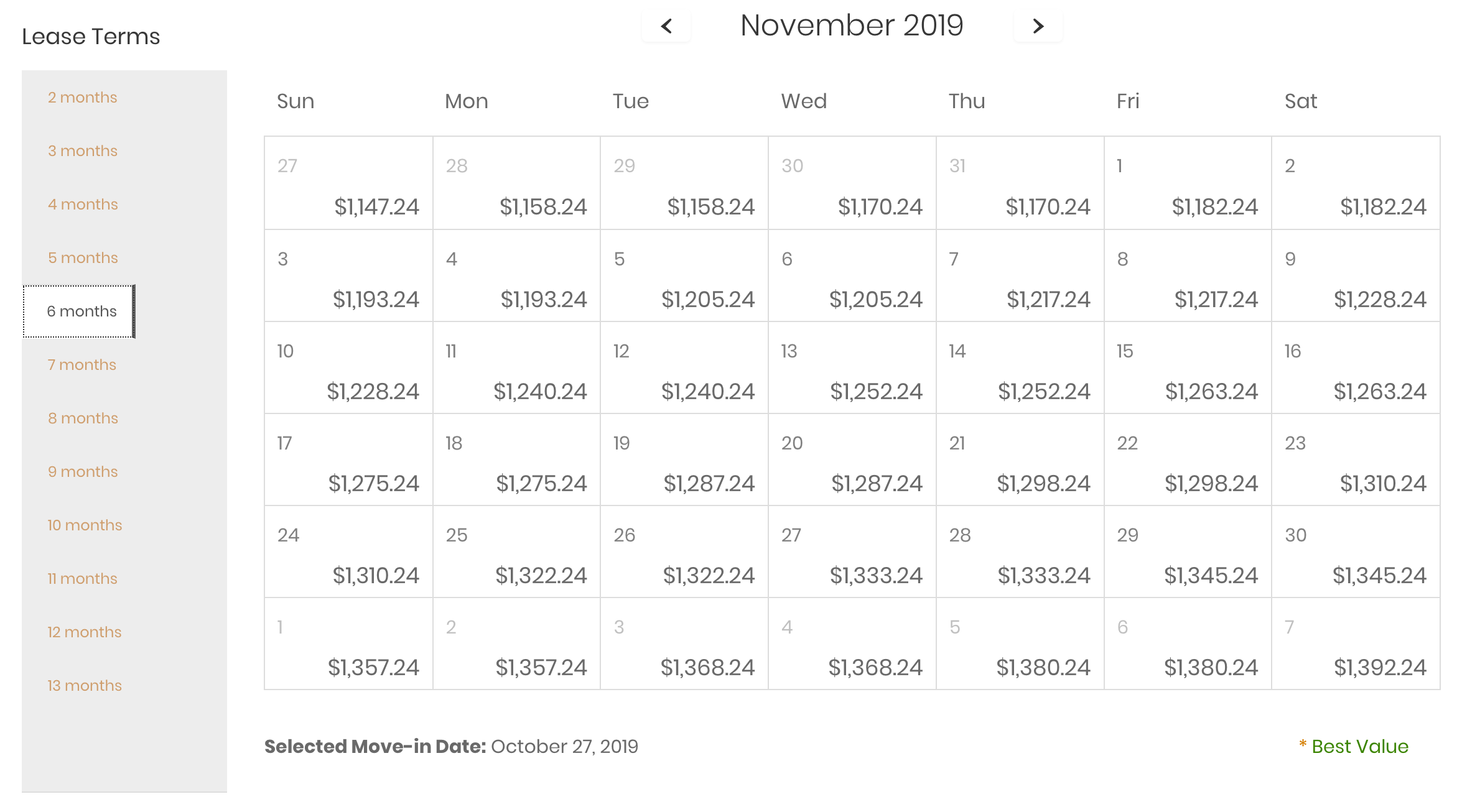

First up, you have to pick your move-in date:

Pick a Move In Date

Uh, what? Prices change every two days? This feels like a Matt Curve issue. Some MBA jerkbutt decided prices should change to maximally benefit property owners at the expense of consumers who just need a place to live.

I asked each property’s leasing office about their price calendars. Two leasing agents shrugged and said “it’s just how things are now” — great job at training your employees to ignore consumer abuse since it’s “just their job” and nobody should question their employers. The third property’s leasing agent said the management company still pays property tax and upkeep fees even on vacant units, so if you select any move-in date in the future, you are being penalized for leaving the unit vacant — even though the delay increases your monthly rent for the entire duration of the lease.

Great job, society.

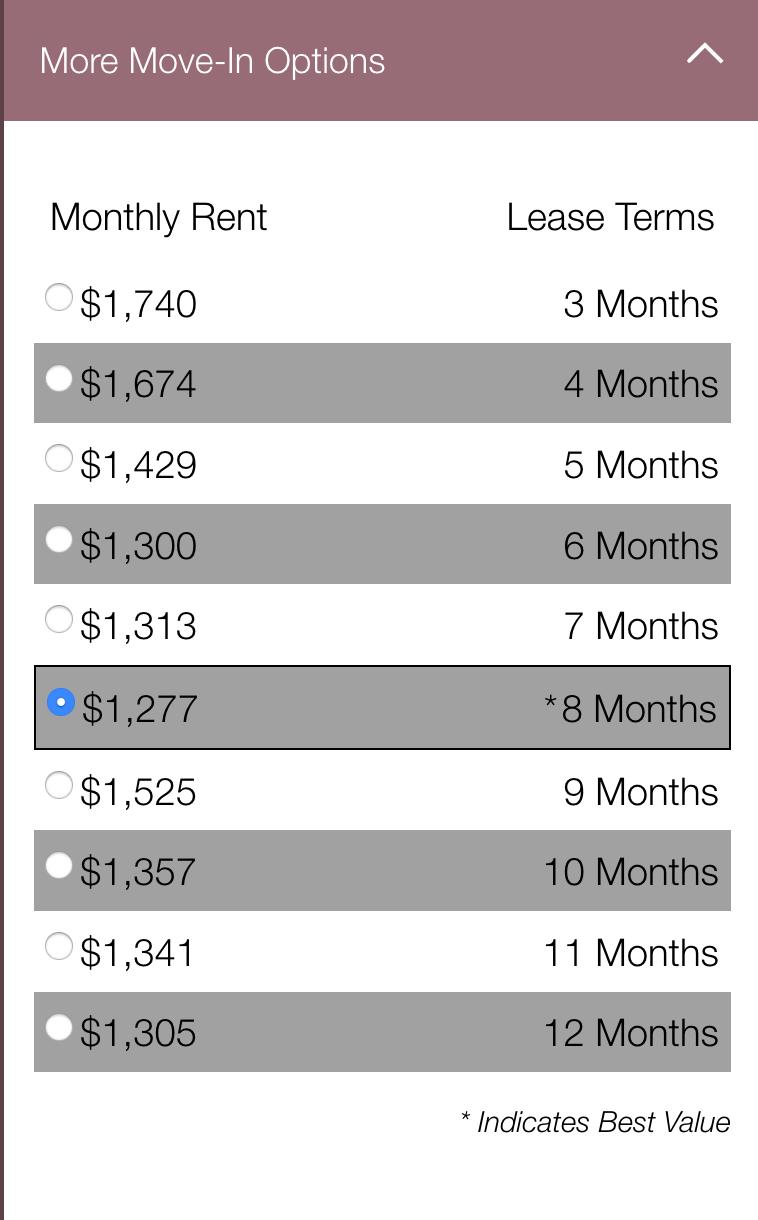

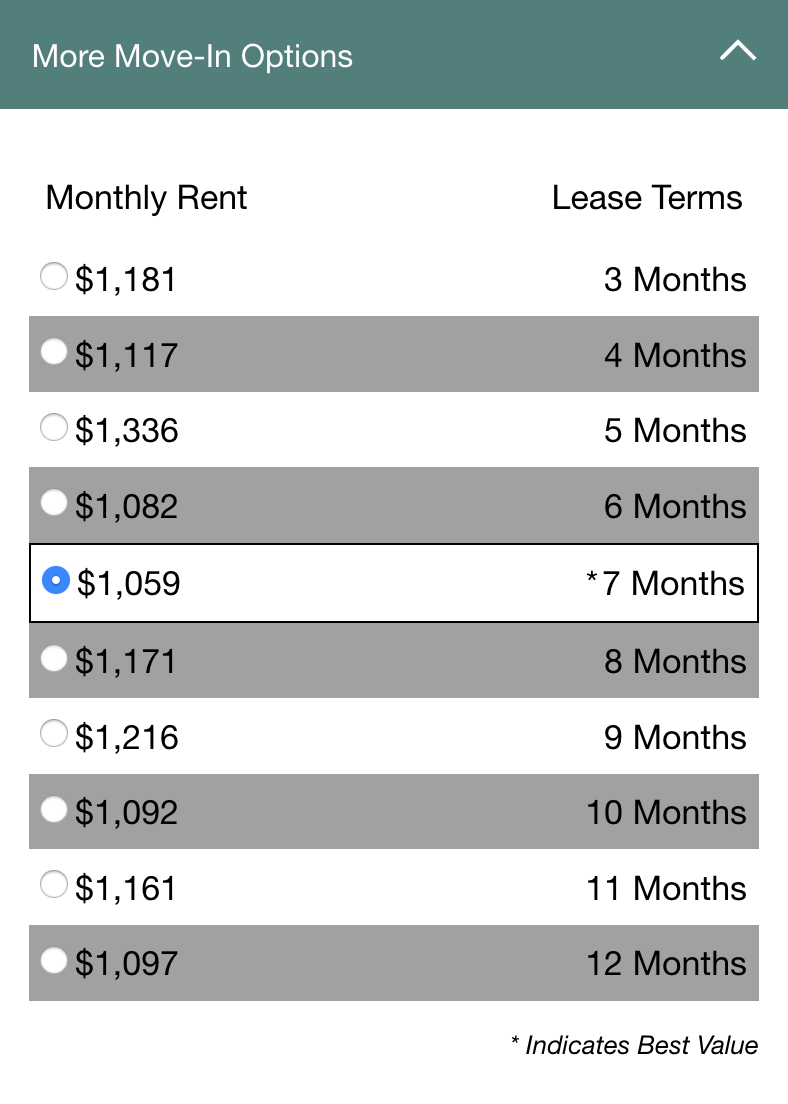

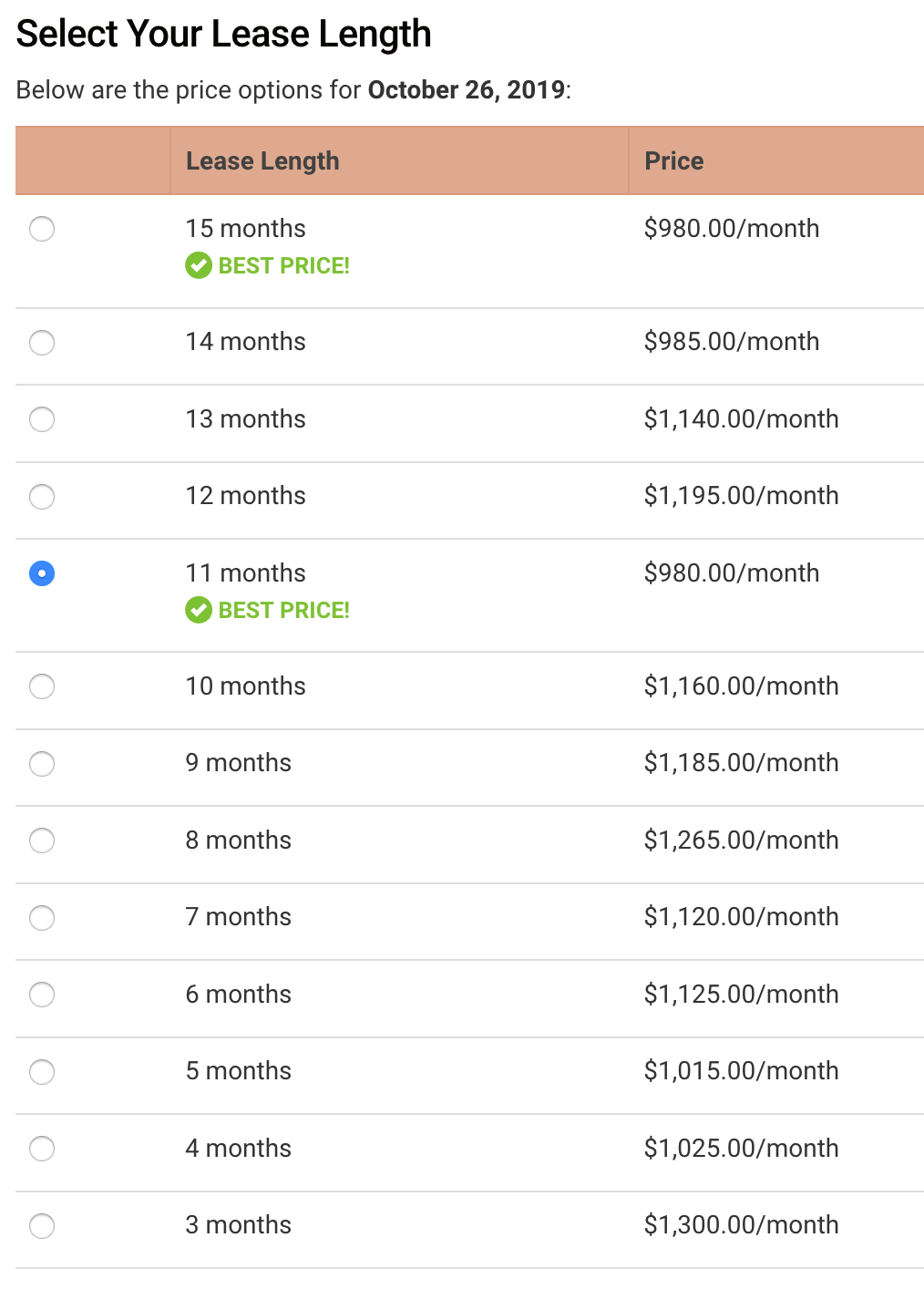

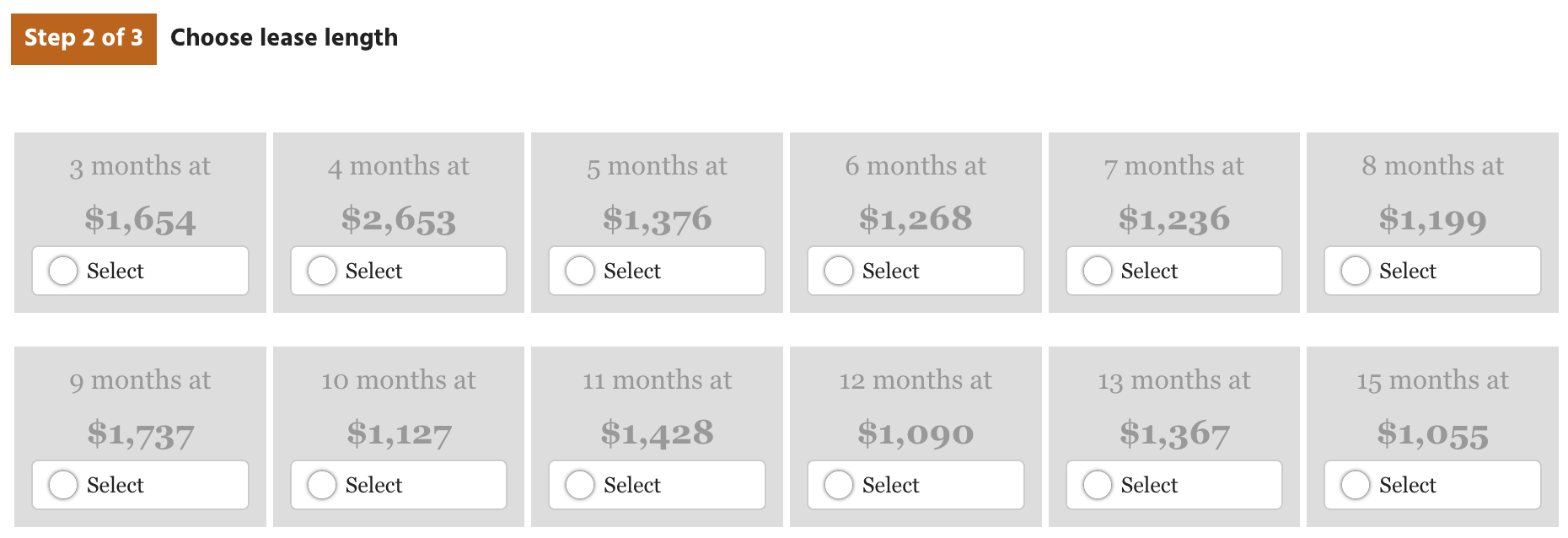

Pick a Term

Since all properties have algorithmic move-in price penalties, all properties also have algorithmic term pricing which often inverts (?) term payment rates.

Notice how sometimes shorter terms are cheaper than longer terms? In the last image, an 8 month lease is $1,199/month while a 9 month lease is $1,739/month! Why?! It doesn’t make sense. Don’t worry though, we can just add more consumer-hostile profit-maximizing algorithms to fix everything.

All properties use similar systems of dynamic by-the-day pricing calendars (on which I found pricing bugs where values change for the same day+term+unit when reloaded a couple hours apart even though the values are only supposed to change once per day) along with dynamic by-the-month lease term calculations. Leasing agents have no idea how any of it works. They just click on things and tell you “the system says you have to pay this much.”

If we had functioning consumer protection laws/regulations, having changes-by-the-day rental pricing along with algorithmic lease term pricing would be illegal. It’s clearly pro-capitalist, pro-property-owner, and anti-consumer. But, we don’t have functioning consumer protection laws. We have the opposite: we protect property and capital above all else, even at the expense of wider societal benefits5. REITs gonna REIT.

You are a child. You will be treated as a child. Do as your property owner says. What are you going to do, move to another property where they have the exact same computer systems running the exact same automated consumer abuse schemes? You have no choice; accept your financial abuse.

Moving on…

Start Application Process

The application process encapsulates typical requirements where you are treated as both child and criminal simultaneously. You have no equal rights in negotiation. You will remain polite and be subservient to capitalist land owners at all times.

Rental Criteria: Applicants must provide at least six (6) months of verifiable rental and/or payment history within the last two (2) years from a landlord, apartment community, mortgage company or military housing facility. Rental history must include a prompt payment record and compliance with all community policies. Acceptable rental history would include no more than two (2) late payments and/or returned checks per year of residency. Reference information from family or friends will not be considered as acceptable rental history verification. Any unpaid rental collection shall be grounds for denial unless paid in full with verification from the community.

Automatic Denial: An applicant will be automatically denied for the following reasons:

- Failure to satisfy the income requirement or minimum credit scoring based on Credit Retriever standards

- Anyone having been evicted within the last 3 years by a previous landlord

- Anyone with an open bankruptcy in the last 10 years

- Any unresolved debts to a landlord or mortgage holder. (Unless debt is paid prior to approval of rental application and applicant can provide documentation from the debtor stating the debt is paid in full).

- Falsification of any information on the rental application.

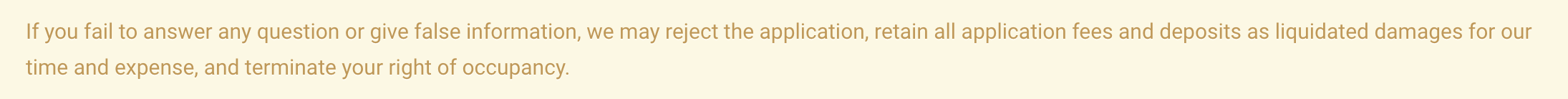

Addendum: Providing false information or not meeting the rental criteria will result in the application being rejected. All application fees, administration fees and deposit will be retained as liquidation damages for time and expenses.

Wow, they even deny you if you filed for bankruptcy anytime within ten years? Half my family would be disqualified from getting rental housing under these terms.

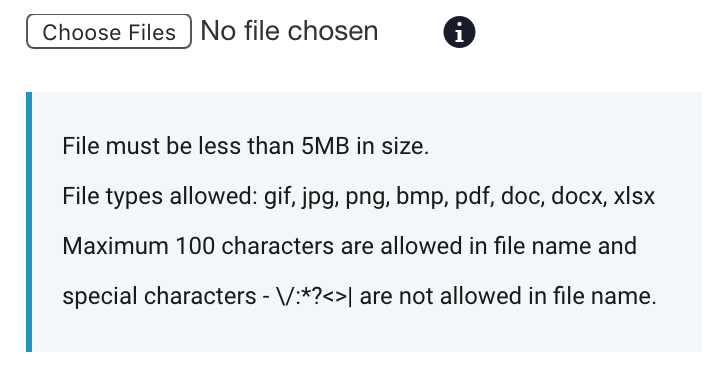

I filled out their all-online application. Their online application was buggy and failing during the entire process. It offered such enjoyable features as taking 2 minutes to respond to every navigation and form submission update.

My initial bank statement upload was rejected because I dared to have a dash in a filename. I’m such an awful person.

For proof of not-being-too-poor, they require income or bank statements for 3 months. But, their form backend rejects multiple files submitted via the same file form element (which their front end allowed!). The frontend-backend disconnect combined with the 2+ minute page load time means it took me about 70 minutes to submit the application (only took 10 minutes to fill it out; the rest was trial and error against their failing service6).

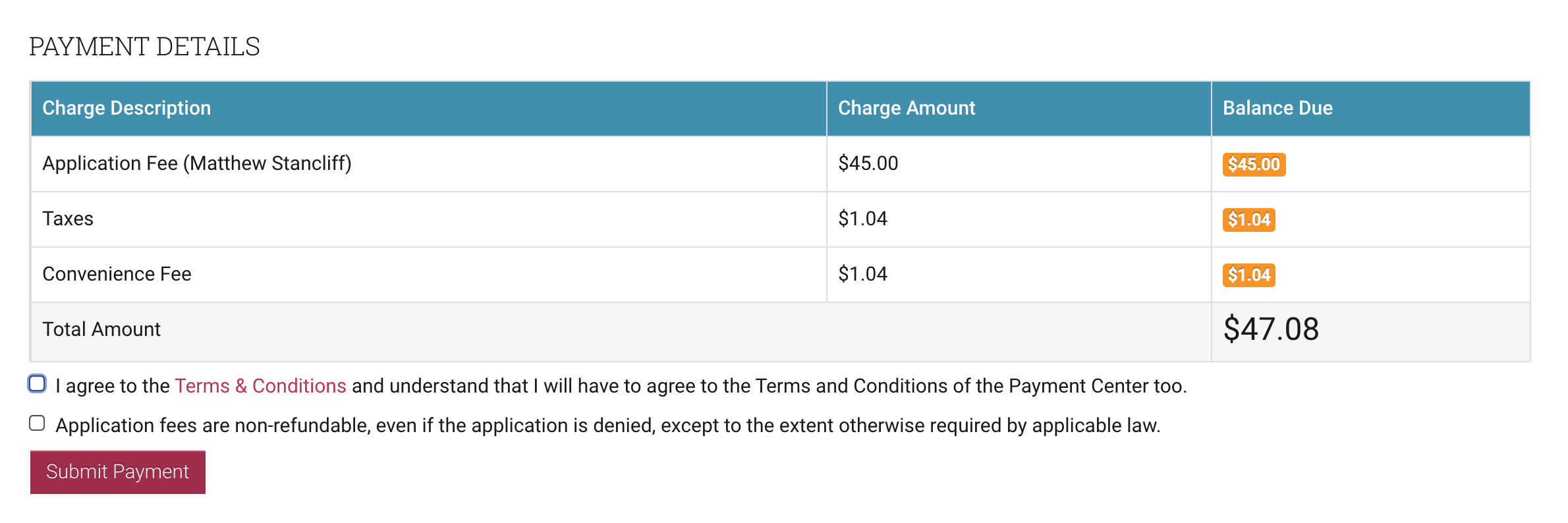

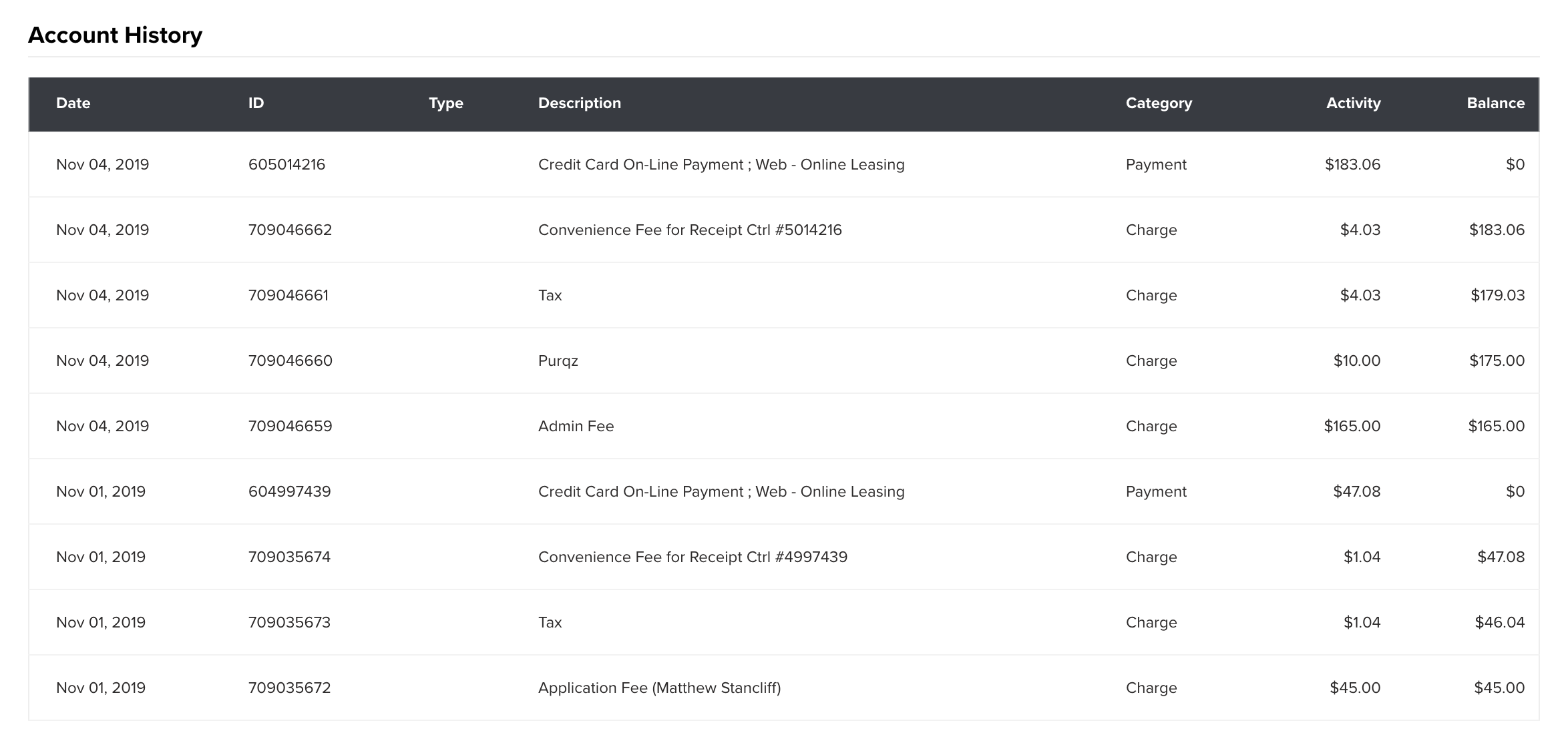

With the first part of the application now complete, it’s time to PAY SOME FEES. WE LOVE FEES.

Remember, customer of a consumer web browser: ENABLE TLS (‽)

You want to rent an apartment here? Enjoy multiple CONVENIENCE FEES from our mandatory billing provider! You must pay your application fees online through our exclusive billing provider. You’re welcome.

“Taxes” is the mandatory 2.3% city rental tax (even for “fees”) and “Convenience Fee” is 2.25% of the entire charge amount.

I imagine businesses based around eating credit card processing fees as a cost of doing business feel like losers when they see housing providers pass through fee collection on top of published rates instead.

Ready to submit your application? Remember, you are both a child and a criminal, so we reserve the right to be maximally economically abusive to you at any time.

…and my application was immediately rejected.

I’m just that special.

I had informed the leasing office I was certifying income by bank statements instead of by paystubs (they allow avoiding income check if you have 3*<rent>*<term> amount in the bank, so for this lease, that amount is around 3 * $1100 * 6 = $20,000), but their web leasing application doesn’t have a concept of alternative income flows. Their post-submittal just rejects you if you don’t meet their formula, leading to the auto-rejection7.

Luckily it only took half a dozen emails to explain the PDF upload problem to the leasing office and get the rejection reversed.

Let’s Go Shopping

While we wait for the leasing office to finish lease processing, let’s shop online for some apartment furnishings! We need… everything.

First up, we have a perfectly legitimate, non-fraud, non-gamed amazon product with (coincidentally) so many perfect ratings it cancels out all the actual bad reviews:

Next up, we have the always useful (read: useless) amazon Q&A section:

Let’s look for some reviews of chairs! Oh, these reviews were paid? Perhaps that’s why they provide no information at all. Happy someone got paid at least.

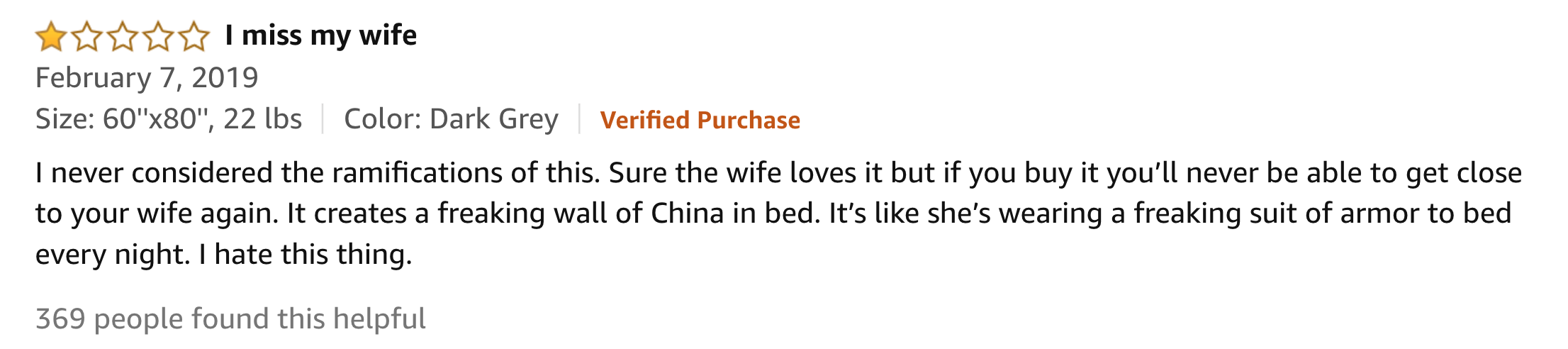

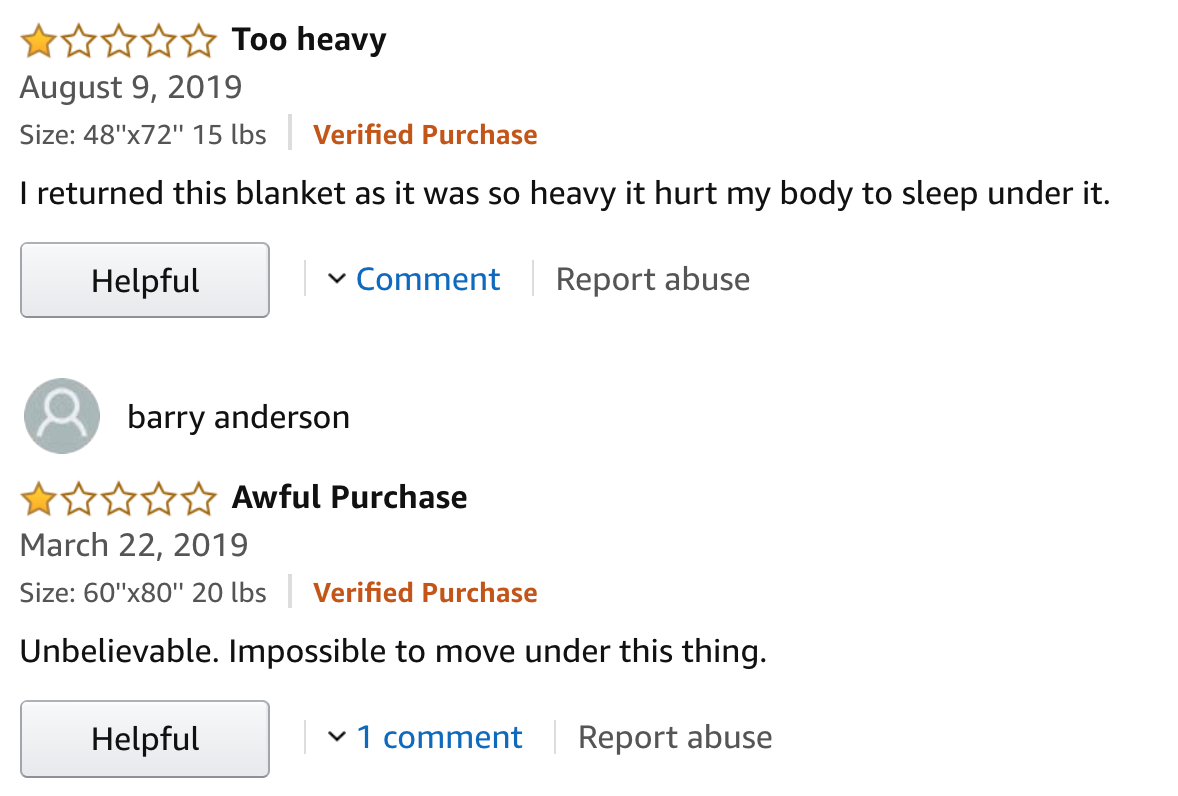

Maybe we need a blanket too. What about a weighted blanket? Oh, gosh, it looks like weighted blankets have… weight. Certainly give heavy products sold as heavy products negative reviews for being exactly as advertised.

While we’re waiting, let’s also sign up for internet access! blast those gigs.

yay, more fees and deposits! remember, you can’t be trusted, you are a potential criminal and must be treated like a child.

At least the “self install kit” arrived less than 24 hours after the order was placed (shipped via UPS but just from other side of the city).

Back to the Lease

The lease is almost ready, we just need to pay even more fees!

What’s a Purqz? No idea. Looks kinda like garbage. You can’t decline the charge, so it’s mandatory. Thanks, property. Their originally advertised administrative fee (now billed as “earnest money”) was $175 + tax, but now we see it’s actually $165 admin + $10 purqz + tax + billing processing fee. Thanks, fees!

Going through the lease

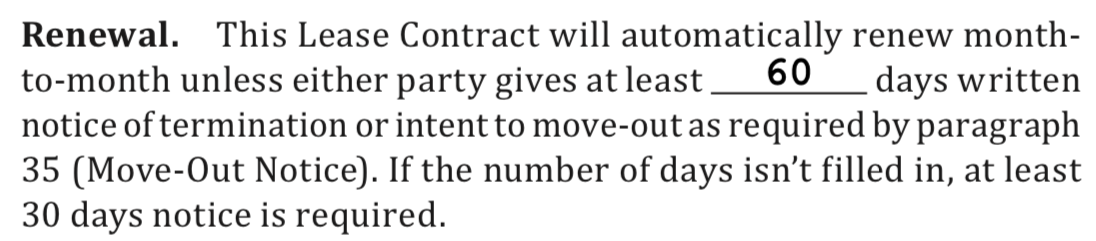

The lease starts off by saying you must notify the owners 2 months before leaving, which seems a bit excessive. Every other lease I’ve had only requires a 30 day notice:

When I asked about these restrictive terms, they said “these are our standard terms. we do not negotiate with renters.”

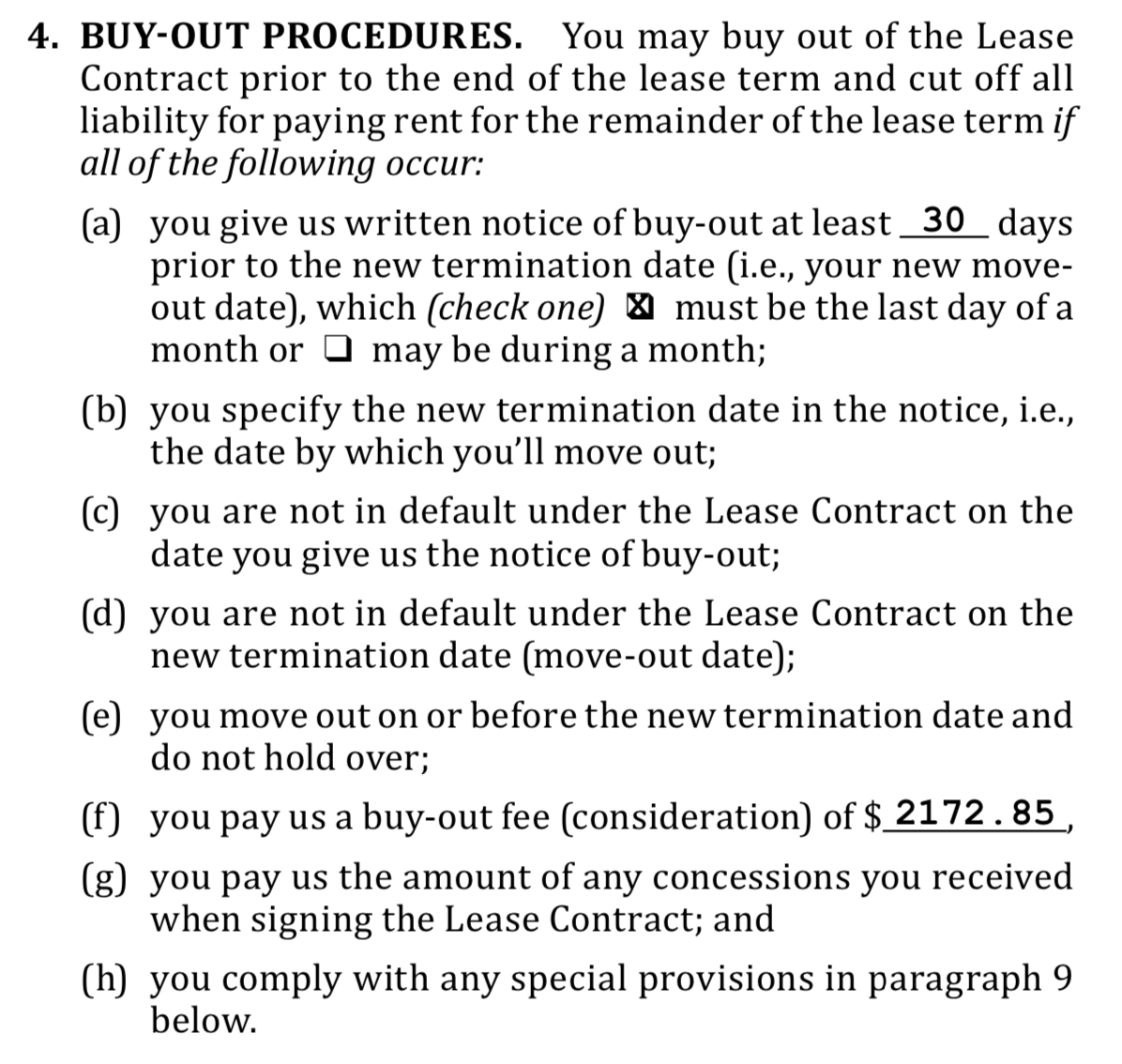

If you don’t provide 60 days notice, the lease continues month-to-month, and then you are stuck either still needing to give 60 days notice or paying 3 months rent to terminate the lease early (30 days notice + 2 months rent = 3 months rent):

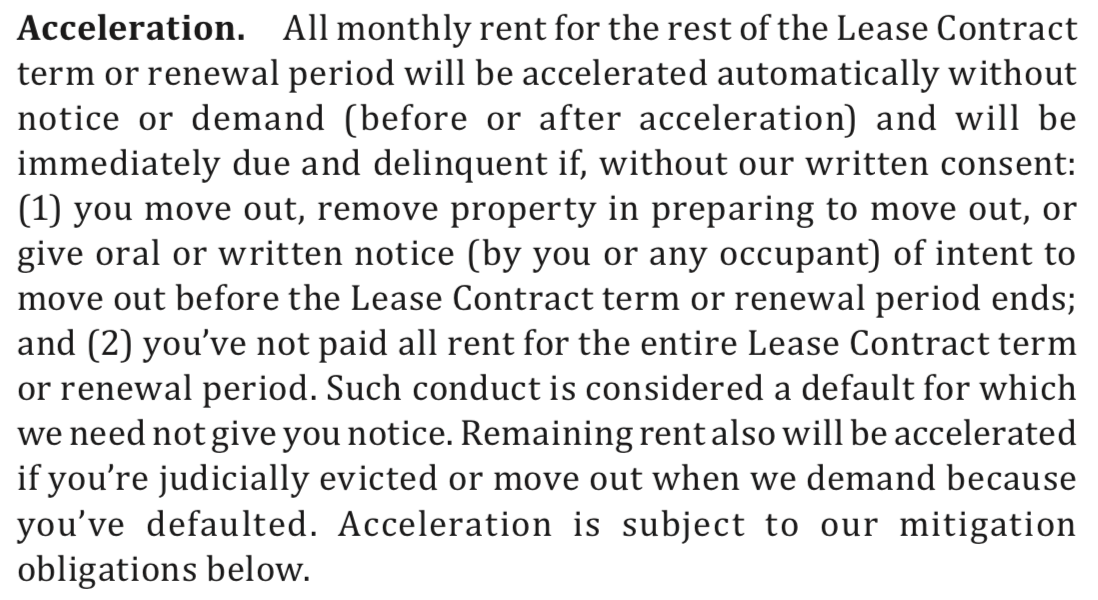

If you don’t pay your first month’s rent, the entire lease is immediately due and they can kick you out, sue you, etc:

If the owners think you may be moving out early, your entire lease amount is immediately due and they can sue you, etc:

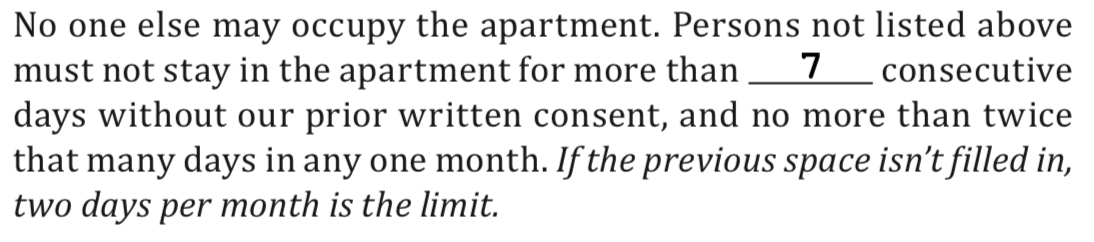

As a weird CYA, they place wildly unenforceable limits on “visitors:”

The administrative fee, which was also described as an earnest money fee, is actually a sub-type of security deposit fee! What a world.

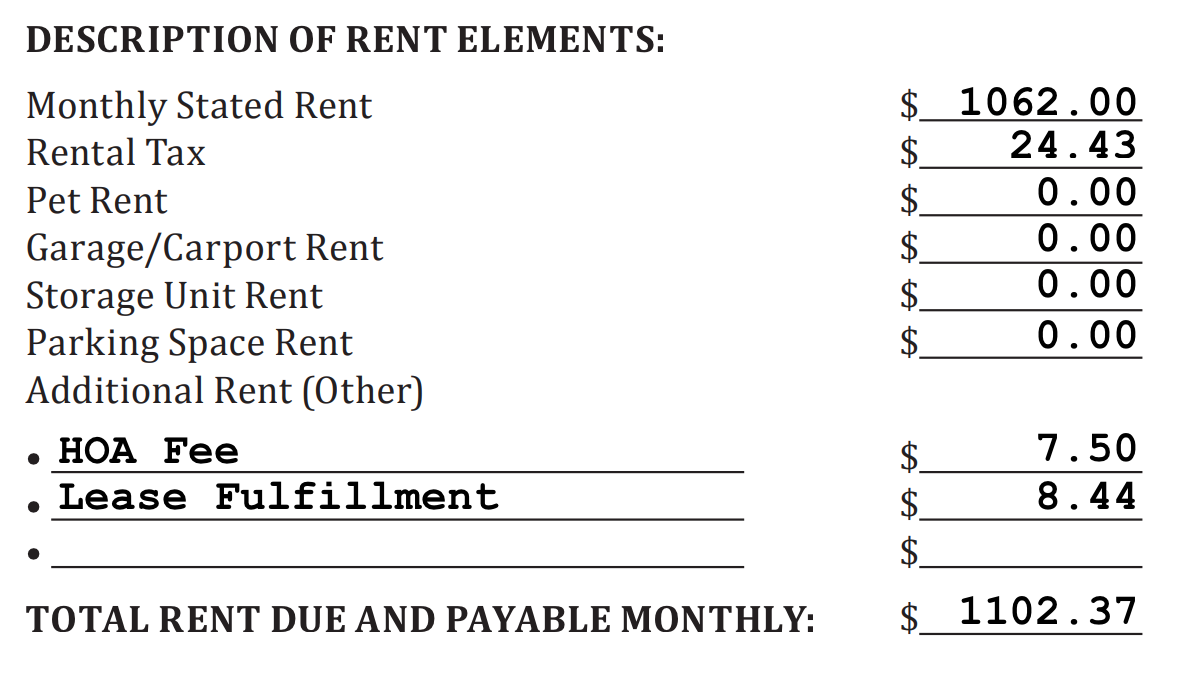

Here’s the final legal rundown of total monthly rent amounts:

We have: actual rent + city anti-renter tax + city anti-renter HOA fee + “Lease Fulfillment” (which is an ongoing $8.25/month + tax non-refundable security deposit). Our originally advertised $1062/month rent is now $1102.37 (+ $4.99/month extra combined billing fee). Thanks, society!

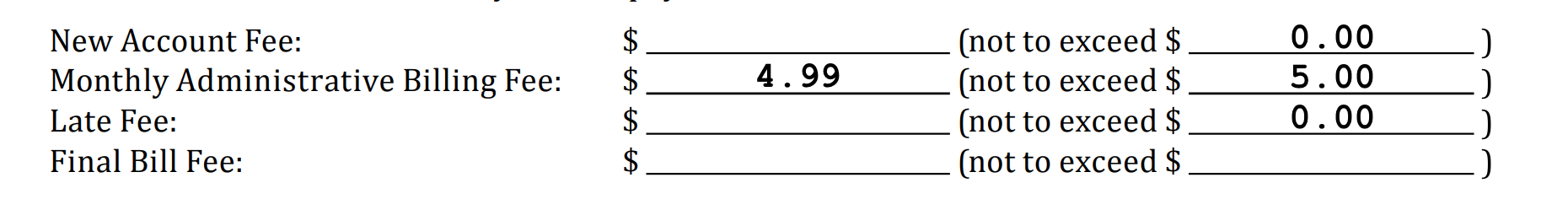

The lease continues on to declare a $4.99/month billing administrative fee for aggregate water/trash/common billing service. Unlike Property 1, this property does not have new account or close account fees for the external billing provider.

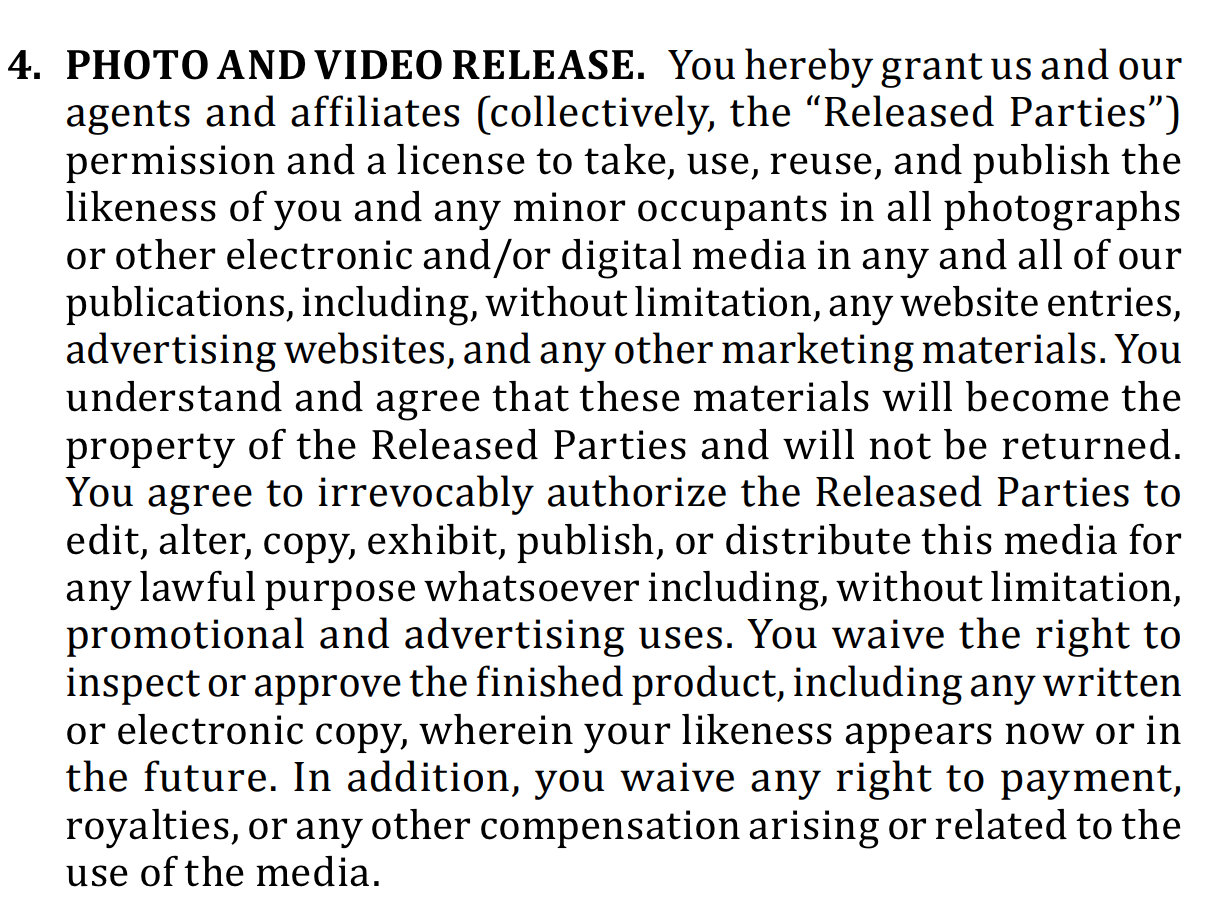

Also, the property retains full rights to your image for all time. For free. By signing this lease, you agree to forfeit any compensation if they sell images of you for their own use. Perfectly normal, right? It’s not like I was using my image or likeness anyway. Your image is now property of your rental management company. Thanks, lawyers and society!

All ready?

Set up Online Rent Pay

Now with the lease signed, let’s set up online rent pay!

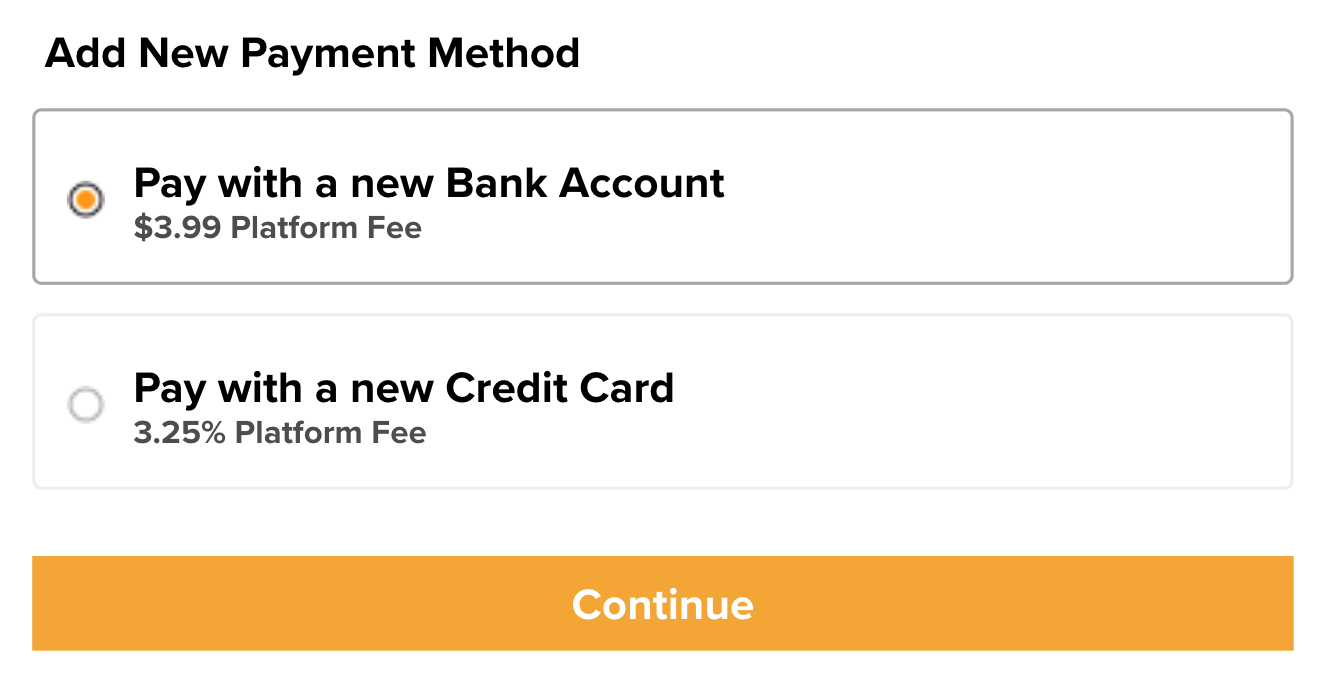

Go to the required billing provider for the property… and… more fees!

also their website doesn’t work at all because they are abusing web integration. Thanks!

Let’s look at the terms for this non-consensual-fee, broke website billing provider:

Everything is fine. Society is normal. Companies own you. You are being treated like a child because you’re probably a criminal trying to steal property. Know your place and pay your fees and don’t look behind the curtain.

MOVING ON

Final Move In Day Requirements

Okay, everything is signed, things are paid up, what’s left? Move-in day fees. Pay remainder of first month rent. Sounds simple, right?

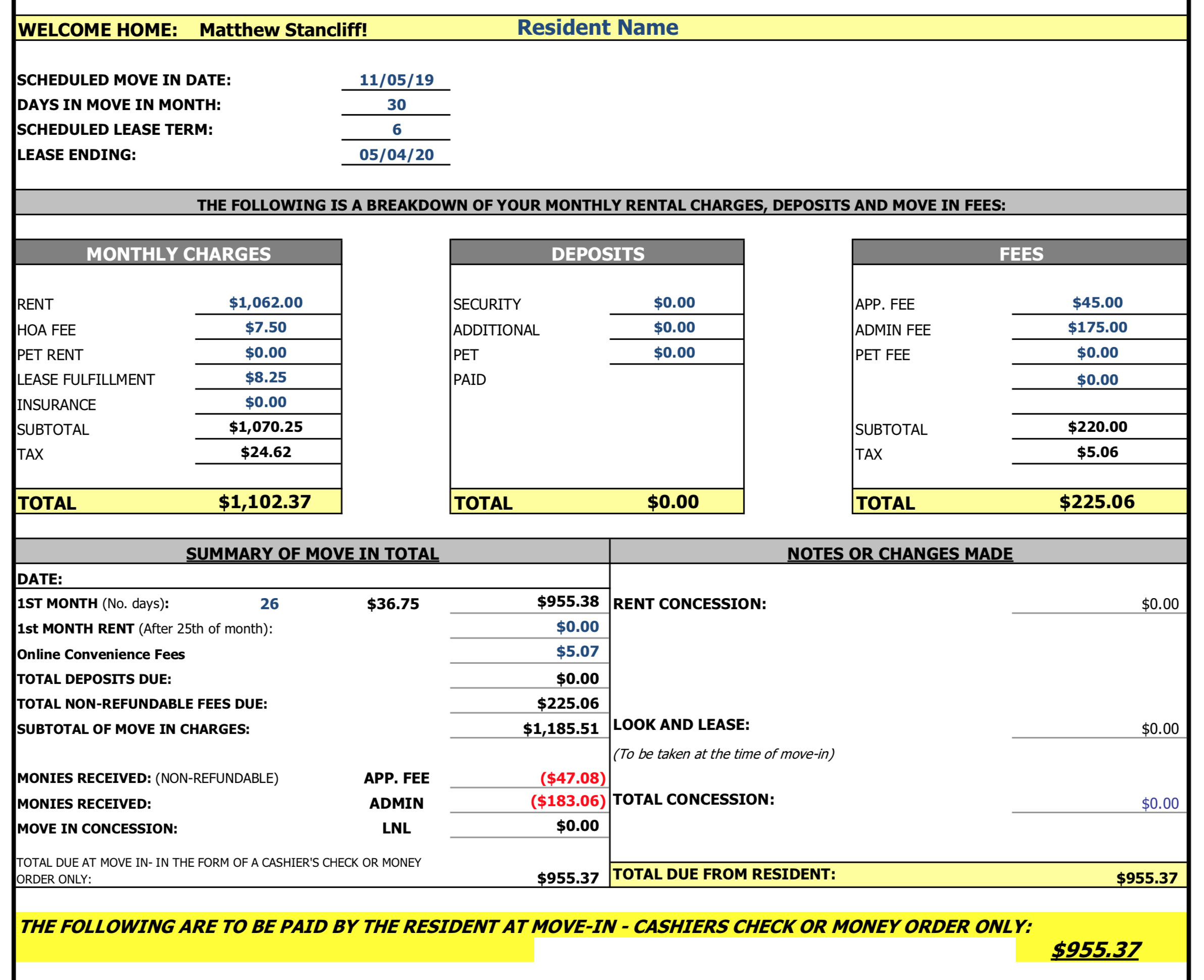

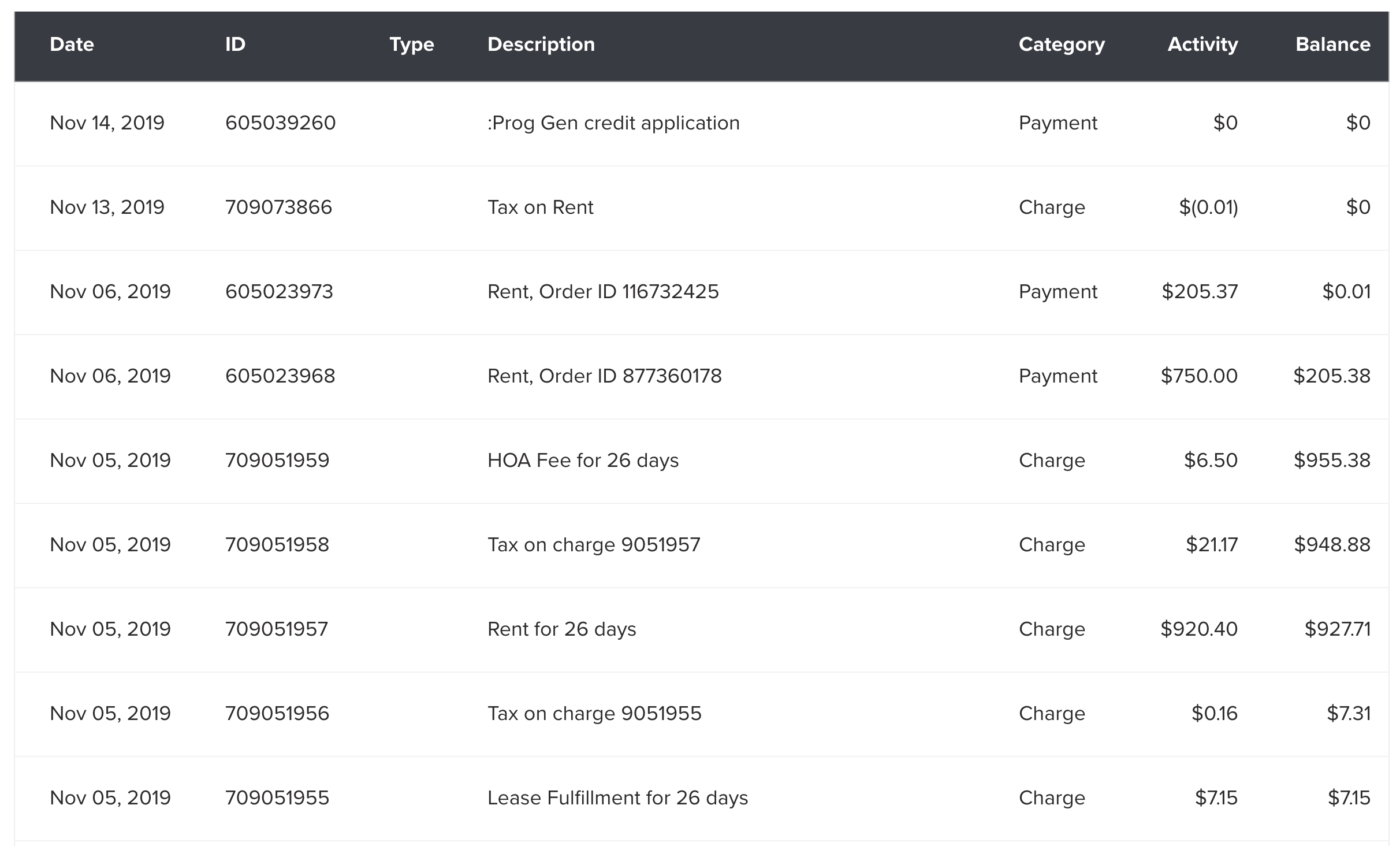

It would be simple… except the leasing office is using a custom spreadsheet to do math and either their formulas are inconsistent or they did poor data entry.

Notice how “1ST MONTH” line is $955.38, but the declared to-pay amount highlighted in yellow is one cent lower? Oops, that’s not right.

Also notice how the “Online Convenience Fees” line is $5.07? That’s not right! And how dare they call excessive payment processing fees “convenience fees!” Those fees were always equal to the tax amount, which also listed here was $5.06 in the FEES box. So, $5.07 in payment processing is wrong, it’s a cent too high—a cent I never paid!—which lowered their initial move in payment by one cent. They were nice enough to credit my account one cent to make up for the literal off-by-one error.

Getting Paid

For move-in we need a cashier’s check or money order on day one. No problem, I’ll hop in a ride share car and go to my closest bank branch.

Destination set, car ordered, get in car, car drops off at location ride share app said was a bank… and there’s no bank there. It’s a grocery store. Going in, looking confused, I ask if there’s a bank branch inside. They kindly inform me the bank branch closed two years ago. Thanks, Internet! Luckily the grocery store also had a generic money counter where they could issue Western Union money orders. Got my move-in day payment for $1.68 in money order fees (plus a $13 ride share round trip charge).

Final Initial Statements

Now with everything paid, here’s the fees and charges it took to move in (also notice the one cent credit due to their spreadsheet error):

So, that’s about the end of it. Overall, how dare they call outsourced billing provider charges “convenience fees” and how dare they make “purqz discount club” mandatory and how dare the city charge anti-renter taxes and how dare the city require apartment renters to pay individual “HOA” fees and how dare they charge $175 “administrative fees” on top of application fees just because nobody can challenge them. Thanks, society!

Bonus Mode

While we’re here, let’s upgrade our phone too!

Verizon Calls

Verizon seems to be committing outright fraud by having giant “APPLE MUSIC FREE ON US!” advertisements, then the fine print says “Actually, that’s just a trial, you will be billed $9.99/month eventually.”

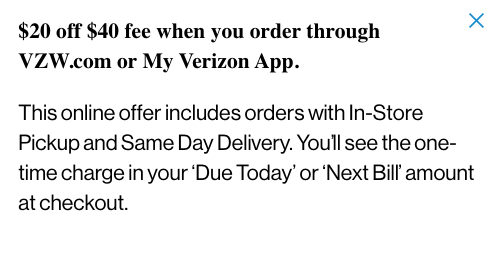

That’s okay though, because they are offering 50% off their totally illegitimate “device upgrade fee” (which is now $40, but used to be $30? When did that change? They added $10 to the fee, but now you get half off by default?):

I wish I could charge people $40 just for updating numbers in a database. Note to self: SaaS idea—autoincrement primary key as a service.

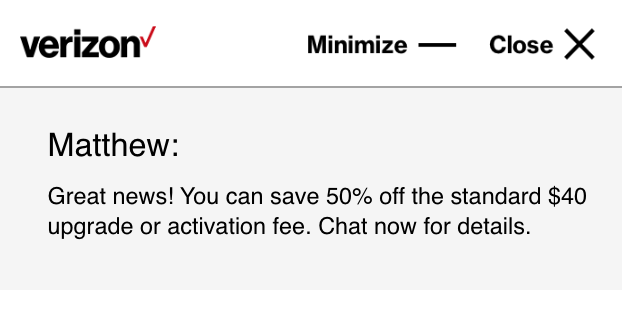

Let’s go ahead with the order. Verizon sends “ORDER COMPLETE!” email first, then disagrees with itself and requires you to fill out the order form again, just to double verify you did place the order, then it sends a final “order actually complete now” email:

(also the verizon website offered me “Same Day” delivery service throughout the entire order process up until… the final screen where it suddenly said “sorry, same day service not available, moving you to 4 day shipping.)

Internet Bill?

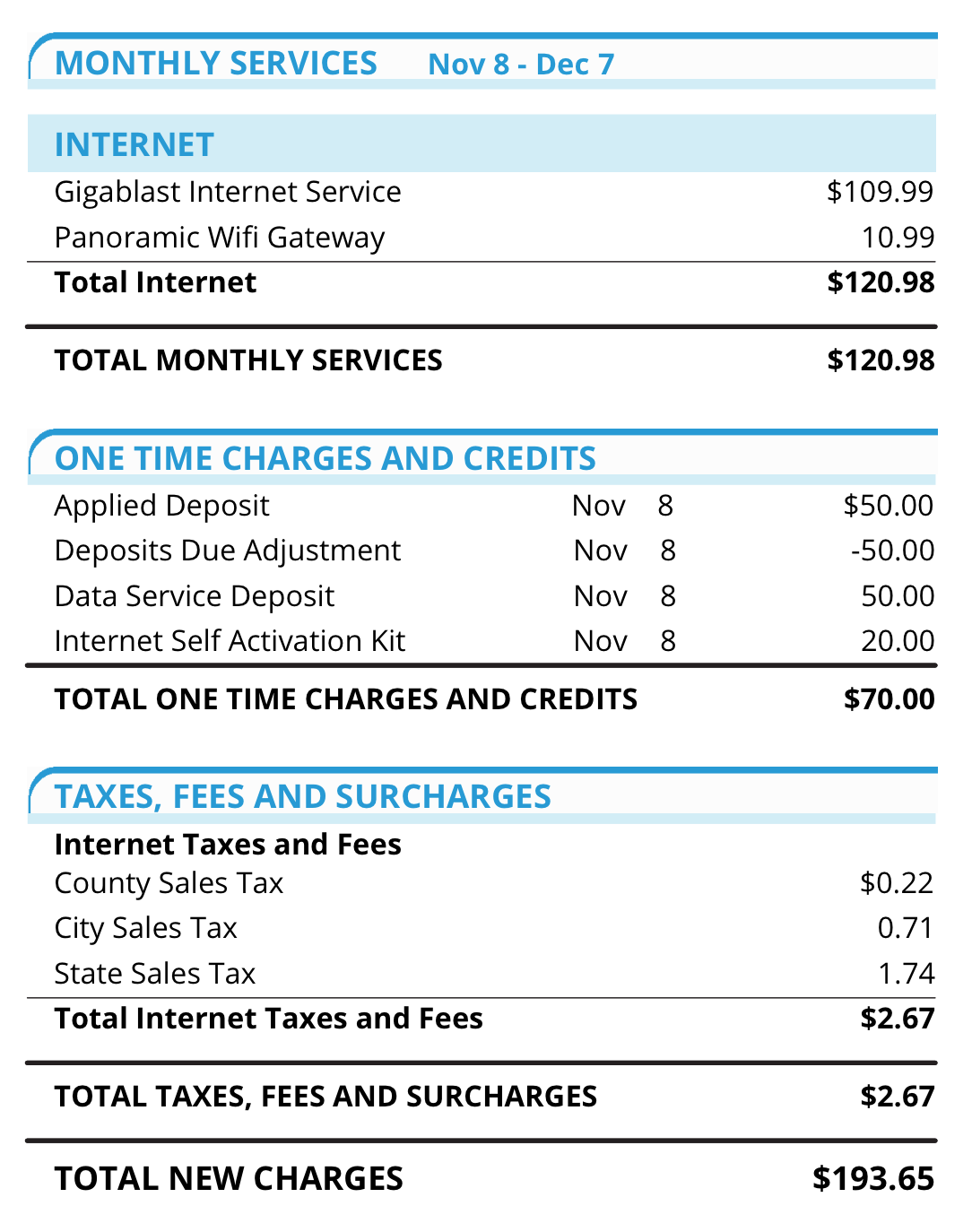

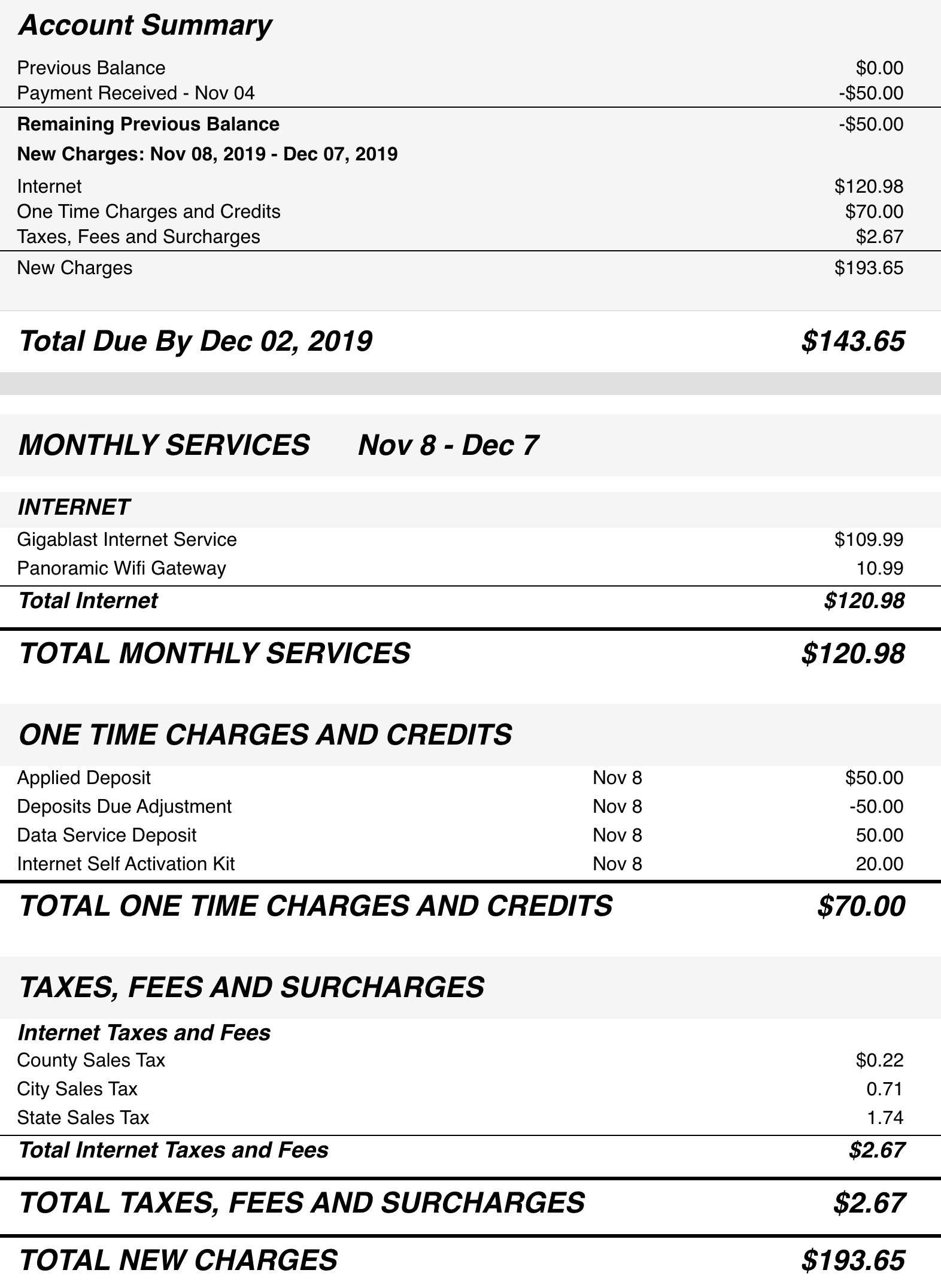

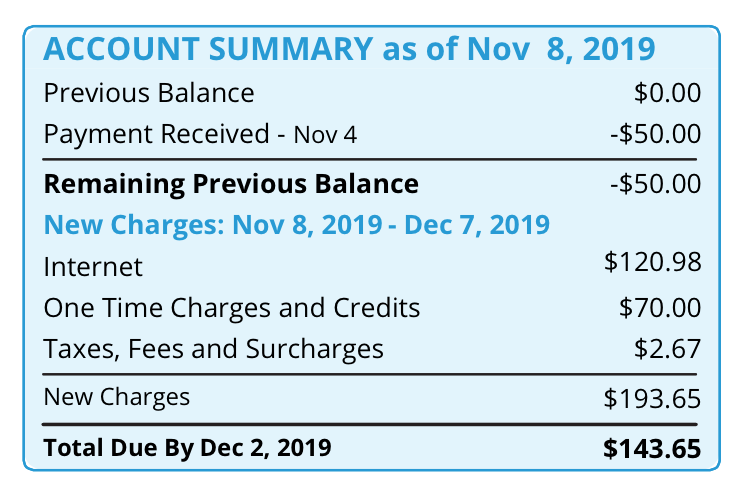

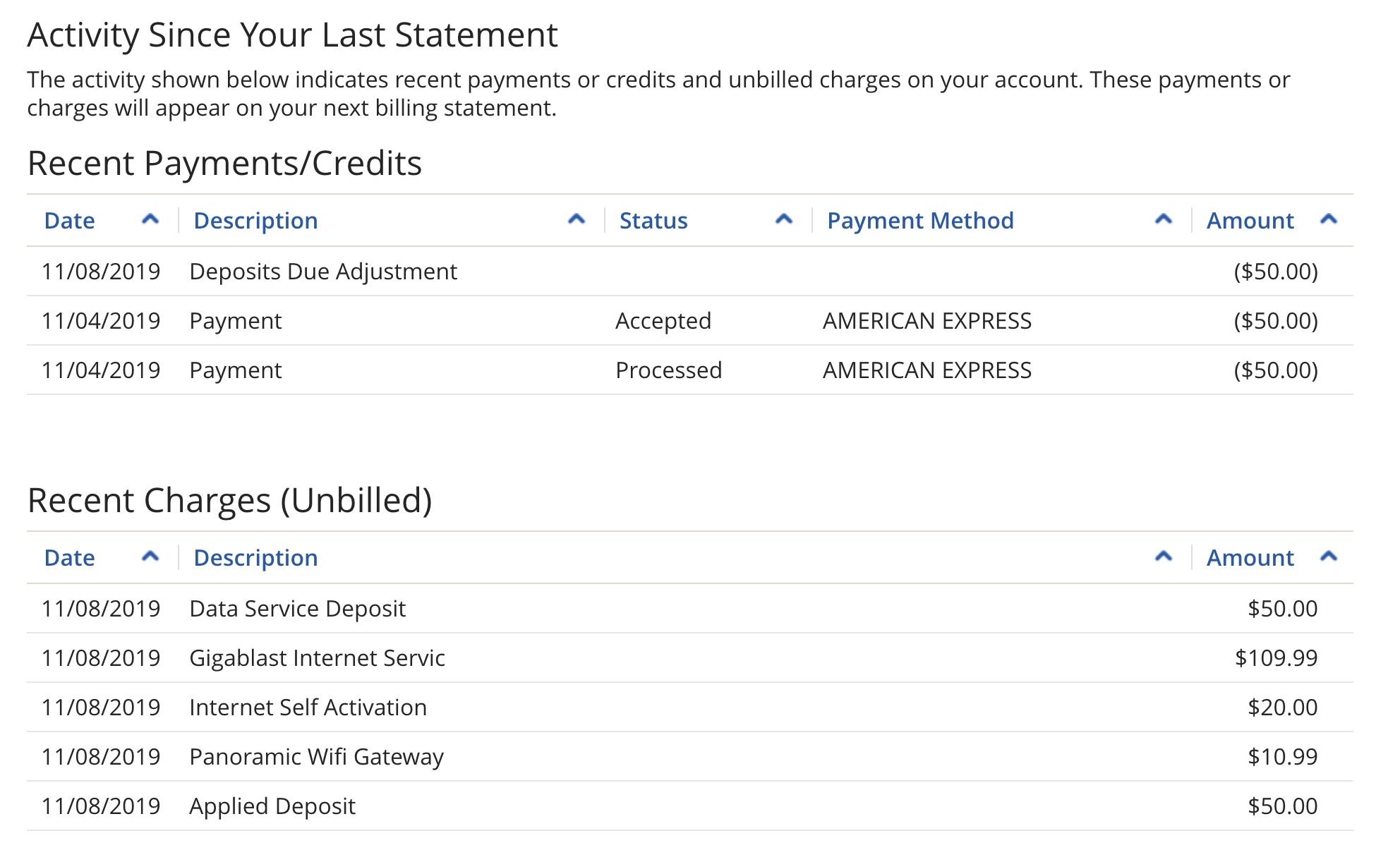

While we’re doing money things, let’s look at the first Internet bill!

The Internet provider is nice enough to give us our bill in four completely different formats with the same numbers, and none of them seem to add up properly. Thanks, Internet!

Why are new charges $193.65 but amount due is $143.65? Why is “Data Service Deposit” there in addition to “Applied Deposit?” What is “Deposits Due Adjustment?” Who knows? Don’t Taunt Internet Billing.

The Internet provider also gives you helpful tips on how to not use their service:

Thanks for buying gigabit internet access, now please don’t use it!

So So Soft

As a final goodbye, let’s thank Amazon for recommending 144 gallons of fabric softner when I searched for laundry items:

Thanks, Amazon!

Conclusion

Finally done. All done with cyclically being judged as a potential criminal by every company you try to start paying. Also the apartment next to me is empty, remodeled, and ready for move in now if you want to live next to me for six months. If you’re nice I’ll even share my gigabit internet access.

This is part 2 of my 2019 moloch series. As citizens we now live to serve corporate interests, pay their fees, and have no representation in how we are treated by abstract owners of our lives; we exist to be treated as potential criminals, so we must be infantalized socially and financially, lest we violate the rights of our gods-on-earth—the capitalist property owners—and there’s no way out.

“fees” levied by corporations are isomorphic to taxation without representation. What are you going to do, use another company with exactly the same opaque fee structure? Give up and pay us our profit margins directly.↩︎

Why tax apartment rentals though? Who knows? These rental taxes seem to have started in 1967 and get updated every so often by voters. The most recent tax increase passed by a margin of 13,000 votes (73k yes, 60k no) out of a population of 1.5 million residents in the area (so, 8% of the population voted; thanks capitalist democracy!).

Currently, the apartment rental taxes are increased to fund public transit because homeowners probably believe only “renters” want transit since homeowners all have multiple murder machines at home. After all: sidewalks, bike lanes, buses, and walking trails are only for poor people in apartments. If you were important and rich, you’d own a house with a least one giant murder machine, right? Don’t be poor or we’ll tax you! You should own a house along with multiple murder machines.

The grand theory of taxes comes in two flavors:

- Economic view: taxes increase costs, therefore decreases demand for

goods; this can be used to manipulate consumer/society behavior

- vice taxes (alcohol, tobacco); not effective with addicted/habituated inelastic demand, ends up being regressive

- plastic bag fees; immoral

- Government view: let’s tax items people have no choice but to

consume as unlimited revenue generators (abuse universal inelastic

demand)

- hotel taxes (lol who cares about visitors? you can’t vote here anyway! oh, you’re visiting family for a month? enjoy paying our $150/month hotel tax to fund exurb highways)

- these weird apartment taxes (you’ve got to live somewhere so you can’t avoid our taxes!)

- income, obviously — most people have no choice but to generate

income, so you can’t avoid income taxes

- though, conservatives like to conflate any income tax with an economic disincentives for actually generating income / wealth / business growth / jobs at all (even though the argument “more income taxes lead to people seeking less income / investment / jobs” has never been shown as a provable effect throughout any period in history, even when marginal tax rates were over 90% for top capitalist pigdogs).

Clearly the apartment taxes take the second approach: tax non-optional economic consumption (housing) to increase revenues since there’s not much of a substitute for living indoors at that latitude in a desert.↩︎

- Economic view: taxes increase costs, therefore decreases demand for

goods; this can be used to manipulate consumer/society behavior

Out here in Real America™, the fees have fees and, look it’s been six months since we added a fee? Time for a new fee! What are you going to do, move? Nah, just pay the extra fees.↩︎

Luckily it was a “no fee” commercial building and not a by-owner rental which, in NYC, typically requires up front: application fee, first month’s rent, last month’s rent, one month security deposit, and rental agent commission based on a percentage of your yearly rent. If you want a by-owner apartment in NYC, you basically have to walk around with $20,000 in your pocket to reserve a unit. Easy, right?↩︎

Welcome to America: property owners are sacred above everything else. You owe your life to make property owners richer, and property owners are allowed to dream up unlimited stackable consumer abuse schemes schemes to extract money from you, while you retain no recourse to defend yourself.↩︎

I had to manually concatenate 3 months worth of bank statement PDFs into one file for the attachment, which caused the leasing office to claim I only uploaded one month of statements because I only sent one document. But, their site rejects multiple documents, and the office didn’t understand the concept of “more than one month in one file.” So, I had to eventually email them 3 individual PDFs instead of using the online form so they could understand I sent 3 months worth of statements. Everything is fine.↩︎

and, of course, the auto rejection was presented after you paid the non-refundable fees, even though the condition to be met was clearly in their app logic and could have presented to you before you submitted—again. any reasonable society would a. have laws/regulations preventing such abuse or b. be full of nice people not treating all customers like criminals and children in the first place.↩︎